Recent Amendment – Equalization Levy

1. Background for introduction of Equalisation Levy

There was a growing distress among many countries that taxes were being avoided by multinational entities (MNEs) from economies where they derive profits. As a result, the Organisation for Economic Co-operation and Development (OECD) and G20 countries embarked on a journey – “Base Erosion and Profit Shifting” (BEPS) Project, to put together a framework of rules/ policies which can be implemented to plug gaps and mismatches in tax rules that were allegedly being exploited by MNEs.

The OECD/G20 BEPS Project seeks to update international tax rules in a coordinated way through 15 Action plans released in 2015. Action Plan 1 (AP 1) deals with tax challenges that arise due to digitization of economies. AP 1 observed that digitization of economies raised a series of broader direct tax challenges primarily related to how taxing rights on income generated from cross border activities in the digital age should be allocated amongst countries. The AP 1 had identified 3 plausible options namely – (1) Nexus based on Significant Economic Presence (SEP), (2) Withholding tax and (3) Equalisation levy.

The Finance Act 2016, drawing reference to the AP 1, inserted a new Chapter titled “Equalisation Levy” (EQ levy) to provide for a levy of 6% on the amount of consideration received/ receivable for certain specified services. The Finance Act 2020 has now expanded the ambit of EQ levy significantly making it very critical for non-resident ecommerce suppliers/ businesses to examine and understand the true scope and applicability of the levy.

2. Overview of the EQ Levy provisions

EQ levy 1.0 – Finance Act, 2016

- Initially when the EQ levy was introduced, it was a levy of 6% on amount of consideration received/ receivable by a non-resident on specified services.

- These specified services were notified to be online advertisements, any provision for digital advertising space, any other facilities or services for the purpose of online advertisements.

- Where the aggregate amount of consideration for the specified services crossed the threshold of INR 1 lakh then the levy of 6% on the amount of consideration was applicable.

- EQ levy was required to be withheld by the service recipient i.e. Indian residents or non-residents with permanent establishments (PE) in India. Hence, though the tax was on the income accruing to the non-resident, the liability to discharge it was upon the recipient of services in India.

EQ levy – 2.0 – Finance Act, 2020

- EQ levy 2.0 now expands the scope of levy to also cover consideration received/ receivable by an

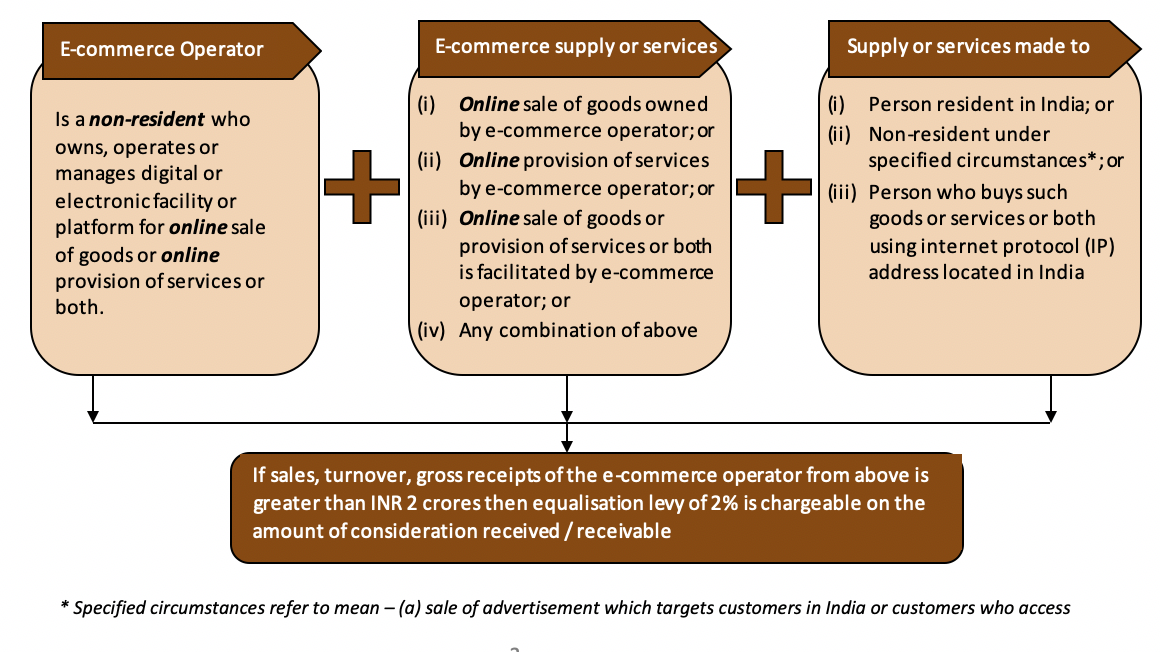

e-commerce operator from e-commerce supply or services made or provided or facilitated by it. Thus, equalisation levy would now be applicable if the following conditions are satisfied:

the advertisement through IP address located in India and (b) sale of data collected from person resident in India or person who uses IP address located in India

- The term “Online” has been defined to mean a facility or service or right or benefit or access that is obtained through internet or any form of digital or telecommunication network.

- Under EQ levy 2.0, the e-commerce operator is required to pay the EQ levy to the credit of the government. Hence, tax is on the income accruing to the non-resident and the liability to discharge it is also upon the non-resident.

- Section 10(50) of the Income Tax Act, 1961 is the only link between the Income tax act and the EQ Levy. The Finance Act 2020 also amended Section 10(50) of the Income Tax Act to provide exemption of income which has been subject to EQ levy from the ambit of total income. However, this exemption is applicable from 01.04.2021 while the obligation to pay equalisation levy rises from 01.04.2020. This gap of 1 year would result in double taxation of the income of non-resident firstly in the form of 2% EQ levy and secondly in the form of tax rates prescribed under domestic law/ double taxation avoidance agreements.

- The Finance Act also provides for provisions relating to filing & processing of annual statement, interest and penalty for non-deduction or delay in remitting equalisation levy, rectification of mistakes and litigation proceedings in regard to transactions subject to EQ levy.

3. Our comments

Digitization has become a key driver for growth and productivity of business, particularly so in the current Covid-19 pandemic situation. The pandemic has brought the digital mandate into sharp focus. The tax related challenges posed by the digital economy is manifold and EQ levy attempts to address these issues.

Considering that provisions of EQ levy have been expanded significantly, it could have implications on ‘online’ intragroup transactions of MNEs. Few illustrations of such transactions could be – (a) Parent provides common platforms to group companies for procurements and invoices them for use of the platform, (b) Parent provides platform to group companies for IT support where group companies raise tickets which are addressed by IT personnel of Parent companies and Parent invoices the group companies, (c) Parent purchases SAP/ERP licenses from vendor and allots licenses to group companies and invoices group companies based on license usage etc.

Further, the term “online” could also include websites maintained by non-residents through which they receive orders for products/ services.

Thus, it is critical that EQ levy applicability in all the above cases be evaluated in detail analyzing the facts of the case and considering the definitions provided in the respective provisions.

Apart from the above, one has to also consider the aspect of appropriately characterizing transactions as royalty/ fees for technical services (FTS) or a transaction to which EQ levy applies. If the transaction is not appropriately classified then there would be a possibility that the transaction would be doubly taxed once under the income tax laws as royalty/FTS and secondly as a transaction which is subject to EQ levy (this is an issue which could arise in the gap of 1 year discussed above). Thus, MNEs must also evaluate and document the character of the transaction for income tax as well as EQ levy purposes.

Leave a Reply

Want to join the discussion?Feel free to contribute!